‘Fintech’ in Colombia: The bet on financial technologies accessible to all

By: Felipe Gaitán García

Photos: Fotos 123rf, Alberto Sierra DOI https://doi.org/10.12804/dvcn_10336.42563_num7

Science and Tech

By: Felipe Gaitán García

Photos: Fotos 123rf, Alberto Sierra DOI https://doi.org/10.12804/dvcn_10336.42563_num7

Aprofound and gradual transformation is taking place in Colombia. Until at least five years ago, individuals –natural or legal– were often forced to carry out transactions or monetary movements through the intermediation of conventional banking institutions, which inherently implied the existence of exclusive logics for sectors of society that were not linked to these institutions. That scenario has been changing dramatically with the accelerated emergence of digital tools that enable greater access to various financial services.

This set of tools is known as financial technologies or Fintech, a concept that alludes to the development of business models that have as support the use of electronic or digital platforms, which reconfigure traditional financial products and services. Innovation, technology, and transformation are the keyelements that shape the industry’s disruptive landscape

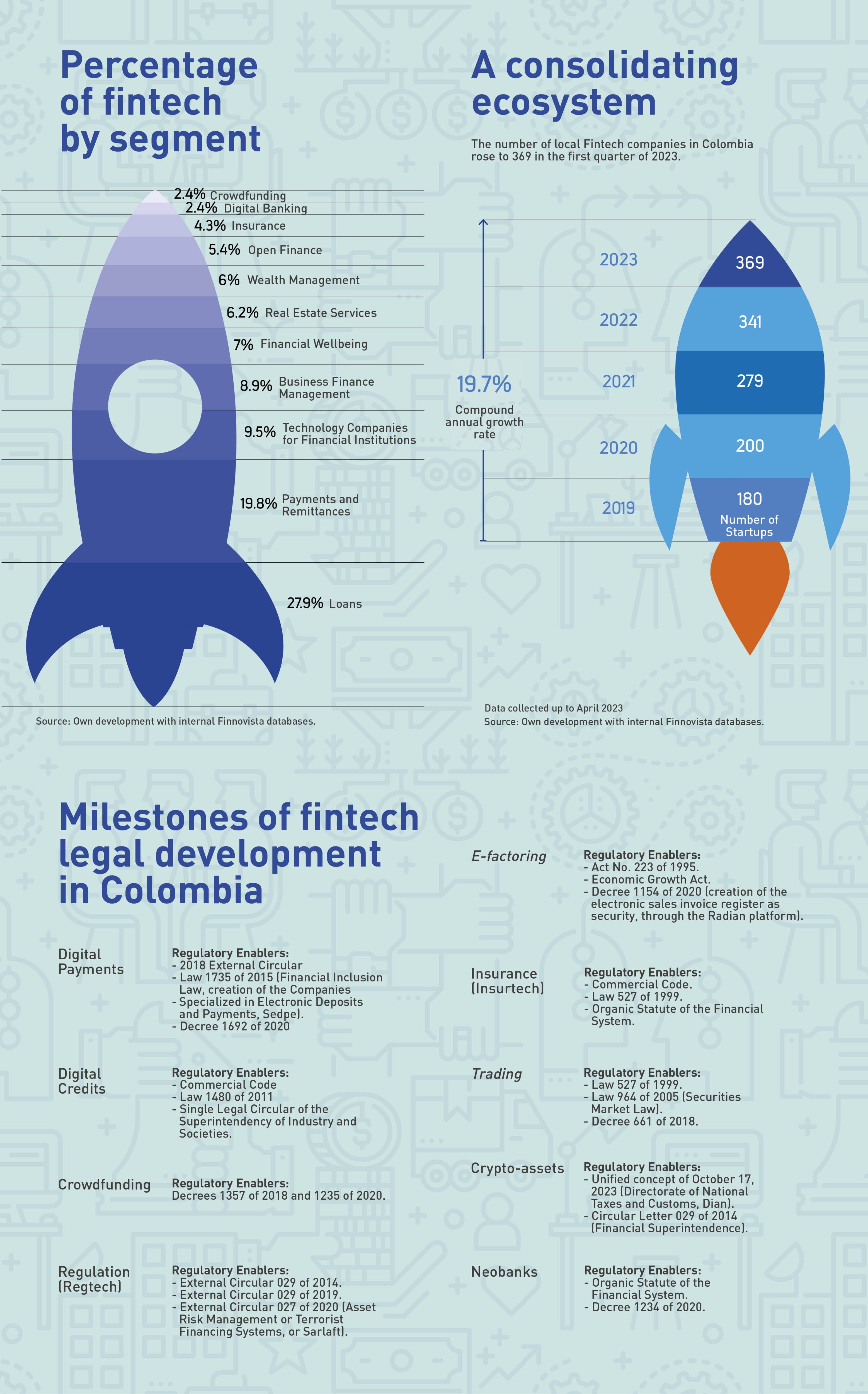

In Colombia, nine segments of such an ecosystem have been classified: digital payments; digital credit; collaborative financing (crowdfunding); regulatory technologies (regtech); business finance and e-factoring; insurance (insurtech); trading and stock market; blockchain and crypto-assets, and electronic money (e-money) and neobanks

According to the report Finnovista Fintech Colombia 2023, during the first quarter of this 2023, the existence of 369 fintech companies was reported in the country, while in 2019 there were 180 and in 2022 the figure of 341 was reached. This represents an annual growth rate of 19.7 percent composed of startups over the past five years. With this, the national fintech ecosystem is consolidated as the third most prosperous in Latin America, only behind Brazil and Mexico

Despite the diversity of technologies and services that converge in the Colombian fintech environment, there are still concerns about the regulatory framework from which these companies can carry out their financial activities in the country. An imaginary that has some acceptance within collective thinking suggests that such companies operate without clear regulation and adequate oversight

With the premise that this paradigm is wrong, the work The legal development of fintech, was created, written by Erick Rincón Cárdenas, a lawyer in Universidad del Rosario and an associate professor in the Faculty of Law at this educational institution. It was published in two volumes by the publisher Tirant lo Blanch. The author aims to dismantle this assumption from an explanatory exercise of each segment, its regulatory contexts, the identification of good practices and the analysis of comparative law against the legislation of other States.

“The book provides elements to debunk an urban myth: that fintech companies are unregulated in Colombia and that there are no applicable rules in their activities. It is quite the opposite, because each of the segments consists of a regulatory framework that allows the full development of the industry,” explains the author, who was also president of Colombia Fintech (2018-2021), an association in which most of the companies in this sector are affiliated.

According to Rincón Cárdenas, the regulatory framework has a uniqueness in Colombia. Unlike Mexico or Ecuador, which have a fintech law that covers the regulatory development of all segments, in the national context an ecosystem has been created in which each sector has its own rules of the game.

"The model of a general fintech law remains in ambiguities that can be complicated from the operational point of view. Our legal development must be different. I think the regulatory framework for each of the segments of the industry is a wise decision,” he adds.

In the same vein, Sergio García Ferreira, a lawyer from Pontificia Universidad Javeriana and a master's degree in Fintech and Financial Innovation from the OBS Business School (Spain), believes that a fintech law is not necessary in Colombia since it can be counterproductive for the industry as there must be a debate in Congress, which may not have the specialized and technical elements. This fintech law is not necessary in Colombia, since it can be counterproductive for the industry as there must be a debate in Congress, which may not have the specialized and technical elements.

With these perspectives, the last five years have been a turning point in terms of advances and regulatory enablers that strengthen the ecosystem in the country. Nevertheless, within the legal analysis of regulations there are gaps to address and opportunities for improvement to continue expanding the universe of the national fintech sector.

Erick Rincón Cárdenas, a lawyer in Universidad del Rosario and an associate professor in the Faculty of Law. Author of The Legal Development of Fintech (2023, Tirant lo Blanch)

Milestones of fintech legal development in Colombia

Although the first fintech standards in the country were conceived more than a decade ago, regulation for the activity of the segments deepened between 2019 and 2021. The turning point was the realization of the document Conpes 4005 de 2020, which formulated the public policy of inclusion and economic and financial education. From there, related technologies gained more relevance at the state level in order to encourage innovation processes and ensure that more people and companies have access to financial products and services.

The most mature segments of the Colombian fintech universe are digital credit and digital payments, which account for 27.9 percent and 19.8 percent, respectively, constituting almost half of the entire national ecosystem and are supported by a solid regulatory framework. The former have payment gateways, electronic wallets and peer-to-peer payments as the most important instruments. The latter focus not on raising money from the public, but on raising private resources and lending them through technology platforms. Their goal is to democratize access to credit. There are currently approximately 90 companies specializing in this activity.

The rest of the sectors remain in full development. This is how crowdfunding, which is a common fund for investment projects, has tended to resolve the tension that companies in this sector maintain with illegal recruitment, based on the surveillance of the Financial Superintendence of Colombia. Regtech, e-factoring, and insurtech also have a specific regulatory framework that allows their implementation based on the regulation of their activities.

The segments that complete the fintech ecosystem are trading (portfolios of investment in the stock market, with small amounts, through the use of mobile applications) and neobanks, institutions that carry out the same activities of traditional banking, but that do not have a physical branch, so they carry out operations of acquisition and placement through electronic means.

The case of crypto assets continues to be discussed around the world. Colombia is among the top 10 nations that move these digital assets on the planet (Bitcoin has 37 ATMs distributed in eight cities). Around the debate, Rincón Cárdenas comments that there are states such as El Salvador where Bitcoin has been classified as a currency, while in others such as China the circulation of cryptocurrencies is prohibited.

At the local level, Colombia has established concepts of state entities (Banco de la República, Superintendencia de Sociedades and Superintendencia Financiera), in which, although their use is not prevented, it is determined that they are not financial instruments and do not constitute a legal tender, so they do not have liberatory power against obligations in the country. This means that no one is forced to receive cryptocurrencies as a means of payment.

“We need rules to regulate the deposit and withdrawal relationship in supervised financial institutions and digital asset traders. The market is pending the approval of a regulation for these operations,” says Rincón Cárdenas. Meanwhile, García Ferreira argues that “in 2014 Colombia did not understand what crypto assets were. We now understand how the market works, but the circular letter limiting regulation of this segment needs to be discussed and updated.”

The challenge of deepening financial inclusion

Colombia has been the scene of historic gaps in access to the financial system. An estimated 70 percent of the population is underbanked or underbanked. This means that a majority of sectors in the country are excluded from making bank movements or have limitations in their financial services, such as when applying for a credit.

The bet of the fintechis to break these barriers and strengthen innovation processes that deepen financial inclusion. According to the report“Fintech in Latin America and the Caribbean: A Consolidated Ecosystem for Recovery,", published in 2022 by Finnovista and the Inter-American Development Bank, Colombia leads the share of financial technologies focused on inclusion, with 41.6 percent of startups and 45.8 percent of the population with access to bank accounts

The COVID-19 pandemic accelerated the dynamics of inclusion of Colombians in technological and financial services, given that social distancing led to the need for the digitalization of money movements. The payments segment was the gateway for a good part of the populations and communities to the fintech, with the added value that these have allowed operations to be more efficient and faster than conventional tools, as well as to be able to access the fintech services and services offered by the financial sector

Thus, in 2020, according to the National Planning Department and the Banking of Opportunities, nearly 800 000 adults benefited from the government’s Solidarity Income subsidy through digital transfers and activated accounts or financial technology products.

Rincón Cárdenas believes that, in principle, traditional banking saw in the emergence of fintech a threat that would affect their own markets. The conventional financial system would soon understand that its articulation with these new business models would strengthen its ability to attract previously neglected populations. Still, financial inclusion gaps remain a challenge.

“Fintechs are not enemies of banking,” says Rincón Cárdenas, adding that two of Colombia’s most important new technologies are Daviplata and Nequi, which have more than 15 million users and go hand in hand with traditional financial institutions. “The fundamental issue is to overcome the barriers to access. Most fintech companies, -and this is a structural ssue- reach the urban perimeters of Colombia. 65 percent are incorporated in Bogotá, while 25 percent are located in Medellín. The remaining percentage in other regions. We must fight to reach the sectors that need them most.”

Experts believe that an adequate regulatory framework is the clearest path to financial inclusion in Colombia; moreover, access to the financial system for as many people as possible contributes not only to the growth and dynamization of the economy, but is also an effective weapon against informality and some illegal practices. Similarly, García Ferreira refers to it when indicating how digital credits become an alternative to the fight against ‘payday’ or express loans

There are other implicit challenges to achieving greater financial inclusion. For example, regulators need to balance legal and operational certainty with innovation and technology processes. “It is necessary that there is a differential regulation for fintech compared to that of the conventional financial system, one that protects the interests of the consumer and personal data, but without having the same regulatory conditions of the financial system,” argues Rincón Cárdenas

The goal is to ensure that financial inclusion is widespread and that users receive products and services tailored to their needs. In this context, the experts emphasize that one of the biggest bets of the national fintech sector is to reduce the use of cash, since its circulation encourages tax evasion and other bad practices related to illicit purposes

One of the scourges that Colombian society has is that we continue to use a lot of cash. One prefers to pay a high sum of money in physical than to do it by electronic means because it will save the 4x1000 tax. Some tax and regulatory asymmetries need to be overcome. The payment scheme needs to be improved. It is something that the Banco de la República has very clear in the system of immediate payments,” concludes the author.

The Colombian fintech industry aims to strengthen financial inclusion initiatives with the certainty that this path will lead, gradually, to such technologies being available to all, which would lead to economic growth. Therefore, as long as there is a regulation that tends to deepen to facilitate innovation processes at the core of the ecosystem, there will be greater opportunities for improvement and competition. In the words of Rincón Cárdenas, ““fintech are the future of the financial system.””.